Budgeting sounds boring—until you realize it might be the one thing standing between you and constant end-of-month stress. Whether you’re living paycheck to paycheck or just want to manage your money better, learning how to create a monthly budget can be a game-changer. Especially in 2025, with living costs climbing, budgeting isn’t optional anymore—it’s survival.

What Is a Monthly Budget?

A monthly budget is simply a plan for how you’ll spend (and save) your money each month. It gives you control over your finances and helps you avoid overspending. Think of it as giving every dollar a job—instead of wondering where your money went, you’ll know exactly where it’s going.

Popular Budgeting Methods

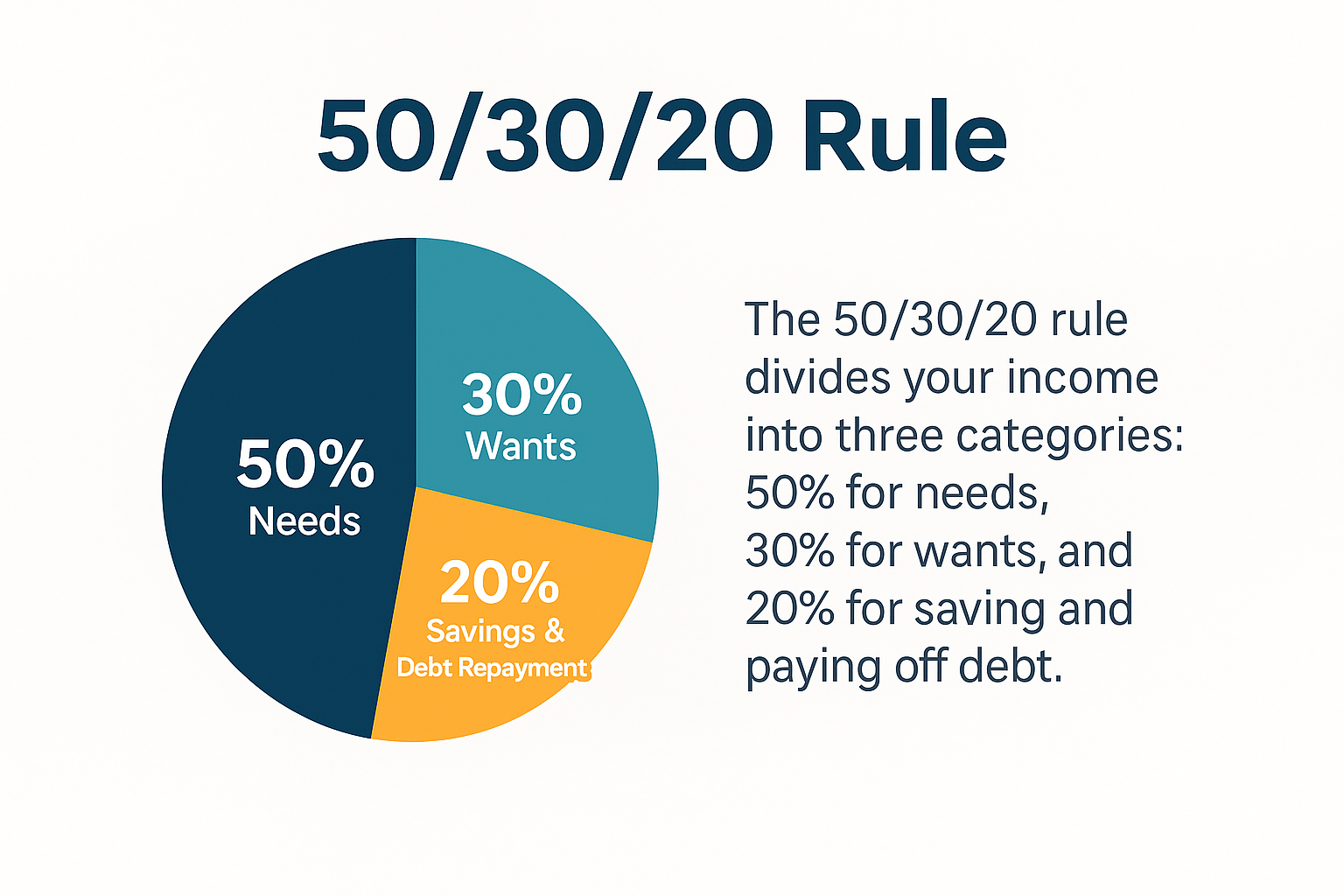

- 50/30/20 Rule: Allocate 50% of your income to needs (rent, groceries), 30% to wants (dining out, Netflix), and 20% to savings and debt repayment.

- Zero-Based Budgeting: Assign every dollar a purpose so that your income minus expenses equals zero.

- Envelope System: Use physical or digital envelopes to divide money into categories; once an envelope is empty, you stop spending in that category.

Step-by-Step: How to Create Your Monthly Budget

- Calculate Your IncomeAdd up your monthly income from all sources (salary, side gigs, etc.).

- List Your Fixed and Variable ExpensesFixed: Rent, subscriptions, insurance.Variable: Groceries, transport, entertainment.

- Categorize and AllocateUse a method like the 50/30/20 rule to break down your spending.

- Use a Budgeting Tool (No Spreadsheets Needed)Want to skip the Excel headache? Try our free Monthly Budget Calculator. It auto-fills expenses using the 50/30/20 rule, and helps you visualize your spending with a pie chart.

- Track, Review, and AdjustBudgeting isn’t a one-time thing. Review your actual spending each month and adjust your budget accordingly.

Final Tips

- Don’t forget to budget for savings and emergencies

- Keep your goals realistic

- Use automation where possible (like auto-transferring money to savings)

Conclusion

Creating a monthly budget doesn’t have to be complicated. With a little planning and the right tool, you can take full control of your finances. Start small, be consistent, and watch how a simple habit like budgeting can bring you more peace, security, and even freedom.

Need help getting started?Try our free Monthly Budget Calculator — your bank account will thank you.

Hi there! Do you know if they make any plugins to safeguard against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any suggestions?

Great post. I am facing a couple of these problems.