Living paycheck to paycheck can feel like running on a treadmill that never stops. But creating a monthly budget on a low income is not only possible—it’s powerful. With the right strategies and avoiding common budgeting mistakes, you can take control of your finances, even if you’re working with minimum wage or supporting a family on limited means.

Whether you’re looking to stretch every dollar, save for emergencies, or simply stop overdrafting your account, this guide is for you.

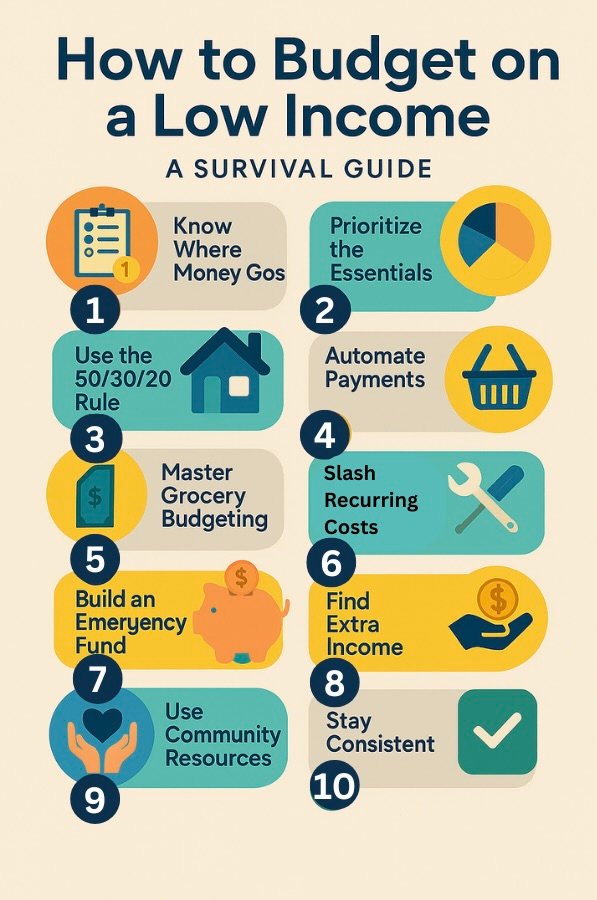

1. Know Exactly Where Your Money Is Going

Start with a simple truth: you can’t fix what you don’t measure. Use a budget calculator or a spreadsheet to track:

- Income (wages, benefits, side hustles)

- Fixed expenses (rent, utilities, transportation)

- Variable expenses (groceries, gas, personal items)

- Unnecessary spending (subscriptions, takeout, impulse buys)

This forms the foundation of your budgeting strategy.

2. Prioritize the Essentials

When your income is limited, your budgeting priorities should be crystal clear. Use the “Four Walls” rule:

- Shelter

- Utilities

- Food

- Transportation

Everything else is negotiable.

3. Use the 50/30/20 Rule (But Adjust It)

The 50/30/20 rule works like this:

- 50% Needs

- 30% Wants

- 20% Savings

If you’re on a low income, even saving 5–10% can be life-changing. Try a 70/20/10 or even 80/15/5 split based on what’s realistic for you.

4. Automate Everything You Can

Set up automatic payments for bills and savings transfers (even if it’s just $10 a month). This helps avoid late fees and builds momentum.

5. Master Grocery Budgeting

This is one of the most controllable expenses. A few survival tips:

- Plan meals weekly

- Buy in bulk when practical

- Use coupons and cash-back apps

- Avoid brand names if possible

If you’re feeding a family, check for budgeting tips for low income families in community forums or Reddit threads.

6. Slash Recurring Costs

Audit your subscriptions. Cancel anything you’re not actively using (that $9.99/month can add up). Call your internet or phone provider and negotiate a better rate.

7. Build an Emergency Fund (Yes, Even on a Low Income)

You don’t need to save thousands overnight. Start with a goal of $100. Then $500. Then one month of expenses. It’s a buffer against chaos.

8. Find Extra Income—Even Small Amounts

From part-time gigs to online surveys, dog walking to flipping items, a side hustle can speed up your financial progress even if it brings in $100/month.

9. Use Community Resources

Food pantries, rent assistance programs, and local nonprofits can provide temporary relief. It’s okay to lean on help while you build your budget.

10. Stay Consistent

Budgeting on a low income is hard—but consistency is the key. Revisit your budget monthly. Adjust where needed. Progress might feel slow, but every smart decision builds a better future.

Final Thoughts:

You don’t need a big paycheck to make smart money moves. You just need a plan—and the willingness to stick with it.

If you’re trying to survive on low income, remember: budgeting isn’t about restriction. It’s about intention.