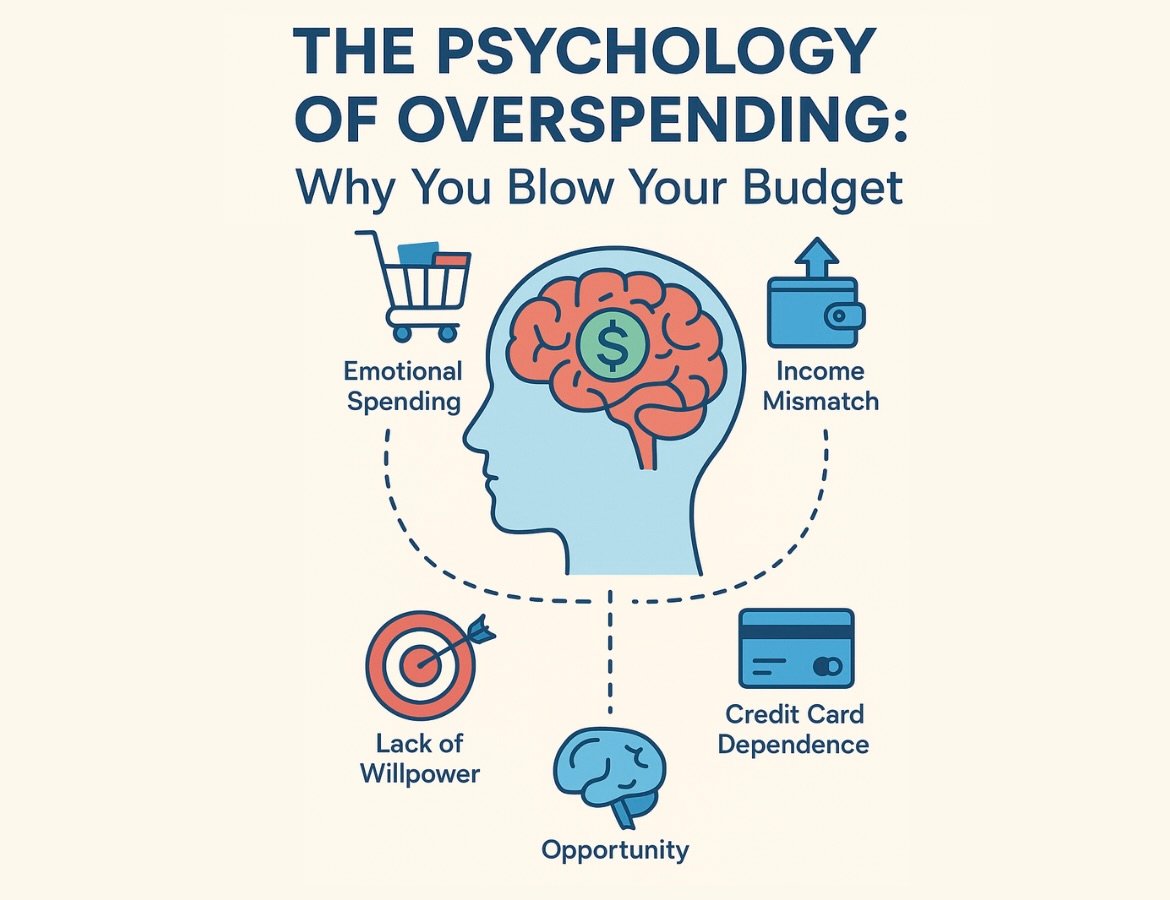

Ever wondered why your paycheck disappears faster than you expected, even though you promised yourself this month would be different? Overspending isn’t always about numbers—it’s about psychology. Our habits, emotions, and even environment play a bigger role in how we spend money than we often realize. Understanding these psychological triggers is the first step toward regaining control of your budget.

Emotional Spending: Buying Feelings, Not Things

Many people turn to shopping as a form of therapy. Whether it’s stress, boredom, or even celebration, spending often fills an emotional gap. The problem is that the joy from retail therapy is temporary, while the dent in your bank account is long-lasting.

Social Pressure and Comparison

We live in an age where Instagram-worthy lifestyles are everywhere. Seeing friends post about vacations, gadgets, or new cars can create a sense of “I need that too.” This fear of missing out (FOMO) can push us to spend beyond our means just to keep up.

The Allure of Instant Gratification

Human brains are wired to seek pleasure now rather than later. Credit cards, buy-now-pay-later schemes, and one-click shopping apps fuel this desire. We get the reward instantly while conveniently forgetting the consequences that show up on our statements later.

Lack of Awareness and Tracking

Sometimes overspending happens simply because we don’t track where our money goes. Small daily expenses—coffee runs, subscriptions, and impulse buys—add up quickly. Without tracking, it feels like the money just “disappears.”

How to Break the Cycle

- Identify your triggers: Notice whether you spend more when you’re stressed, bored, or influenced by social media.

- Delay gratification: Give yourself 24 hours before making non-essential purchases.

- Set realistic limits: Use tools like the 50/30/20 rule or budgeting apps to create spending boundaries.

- Automate savings: By paying yourself first, you’ll have less temptation to overspend.

Overspending isn’t a lack of discipline—it’s often a battle with emotions and psychology. Once you understand what drives your financial behavior, you can create healthier habits that protect both your money and peace of mind.