Budgeting is often described as the backbone of financial stability, but finding the right system isn’t always straightforward. For years, the 50/30/20 budget rule has been one of the most popular methods for managing money. It divides income into neat categories of needs, wants, and savings. But here’s the catch: not everyone’s lifestyle or expenses fit neatly into that formula.

That’s where the 60/20/20 budget rule comes in. Designed to provide a little more breathing room for necessities while still keeping savings and discretionary spending in balance, this rule can be a better fit for certain households. But how exactly does it work — and more importantly, is it better than the 50/30/20 rule? Let’s break it down step by step.

What Is the 60/20/20 Budget Rule?

The 60/20/20 budget rule is a financial framework that splits your after-tax income into three main categories:

- 60% for essentials: rent, utilities, groceries, transportation, insurance, and other non-negotiables.

- 20% for savings and debt repayment: emergency fund contributions, retirement accounts, investments, and extra payments on loans.

- 20% for wants and discretionary spending: dining out, entertainment, hobbies, travel, or lifestyle upgrades.

At its core, this rule prioritizes your monthly budget toward covering needs first, giving you a larger cushion for housing, bills, and other necessities. It’s particularly helpful for families or individuals living in high-cost-of-living areas where limiting essentials to 50% of income (as in the traditional 50/30/20 budget) simply isn’t realistic.

How to Apply the 60/20/20 Rule in Real Life

Let’s say your take-home pay is $4,000 per month. Following the 60/20/20 rule, your budget would look like this:

- $2,400 (60%) for essentials: rent, car payment, groceries, health insurance, utilities, and transportation.

- $800 (20%) for savings and debt repayment: building an emergency fund, retirement contributions, or tackling high-interest debt.

- $800 (20%) for wants: subscriptions, restaurants, vacations, shopping, or hobbies.

This method is straightforward, but the challenge comes when your expenses don’t align neatly with the percentages. For instance, someone trying to budget on a low income may find even 60% isn’t enough for essentials like rent and groceries. On the flip side, high earners might realize that sticking to just 20% for discretionary spending leaves plenty of room to boost savings.

Pro Tip: Use separate accounts or budgeting tools to allocate your 60/20/20 categories automatically. This makes it easier to stick to a budget without constantly tracking every small expense.

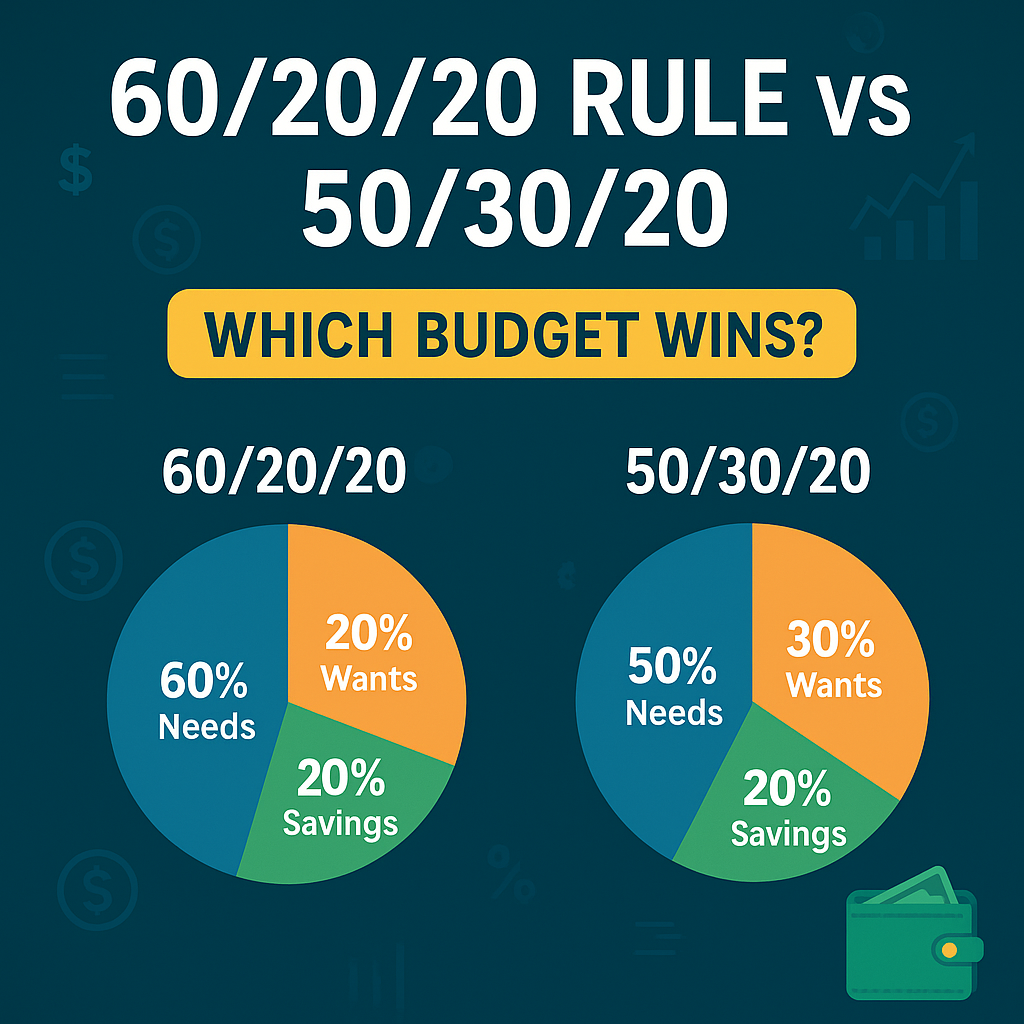

60/20/20 Rule vs. 50/30/20 Rule: A Side-by-Side Comparison

To really understand the difference, let’s compare both rules:

| Category | 60/20/20 Rule | 50/30/20 Rule |

|---|---|---|

| Needs | 60% | 50% |

| Wants | 20% | 30% |

| Savings/Debt | 20% | 20% |

Key differences:

- More flexibility for essentials: With 60% allocated to needs, the 60/20/20 budget is better for people whose housing or transportation costs are higher than average.

- Reduced discretionary spending: Wants drop from 30% to 20%, which can feel restrictive for those who enjoy a lifestyle with more entertainment or travel.

- Savings remain equal: Both rules keep savings at 20%, which means you’re still prioritizing long-term financial security.

Pros and Cons of the 60/20/20 Budget Rule

✅ Advantages

- Ideal for high-cost living: Perfect if you live in cities where housing eats up more than 30% of your income.

- Still encourages saving: Unlike more relaxed systems, it ensures at least 20% goes toward savings or debt repayment.

- Simple and flexible: Easy to follow without requiring complex math or spreadsheets.

❌ Disadvantages

- Less room for fun money: If you enjoy dining out, traveling, or hobbies, trimming wants down to 20% might feel tight.

- Not personalized enough: Unlike zero-based budgeting, this rule doesn’t give every dollar a job, which can make it harder to control spending habits.

- May not fit irregular income: For freelancers or anyone budgeting with irregular income, sticking to fixed percentages can be tricky.

Who Should Use the 60/20/20 Rule?

The 60/20/20 rule works best for:

- Families with higher fixed costs: If your rent, childcare, or health insurance takes up a big chunk of your monthly budget.

- Couples budgeting together: It provides clear guidelines that reduce money conflicts when you’re budgeting as a couple.

- People living paycheck to paycheck in expensive cities: By allowing more for essentials, it’s easier to manage bills and avoid falling behind.

- Those who want balance: It still leaves room for saving and fun, even if discretionary spending is more limited.

If you’re someone who struggles with overspending on wants, this rule can actually help you rein things in while still giving yourself some leeway.

Tips to Stick to the 60/20/20 Budget

Even with a simple system, the real challenge is consistency. Here are practical tips to make it work:

- Automate your savings: Treat your emergency fund and retirement contributions as non-negotiable expenses.

- Use sinking funds for big goals: Whether it’s a vacation or holiday shopping, setting aside small amounts each month prevents debt later.

- Review your budget quarterly: Expenses change, so adjusting helps you stay on track.

- Pair it with frugal living tips: Small lifestyle tweaks like meal planning, couponing, or reducing subscriptions can free up more money for wants and savings.

- Track cash flow closely if you have irregular income: That way, you can still keep percentages in balance, even if paychecks vary.

Final Verdict: Is 60/20/20 Better Than 50/30/20?

The truth is, neither rule is universally “better” — it depends on your situation.

- If you live in an affordable area, have manageable housing costs, and want more flexibility for lifestyle spending, the 50/30/20 budget rule may feel more balanced.

- If you’re facing steep rent, family expenses, or higher fixed costs, the 60/20/20 budget rule gives you the breathing room you need without sacrificing savings.

Ultimately, the best budget rule is the one you can actually stick to. Try experimenting with both, track your progress for a few months, and adjust until you find a rhythm that works for you. After all, the goal of any budgeting system is not perfection — it’s progress.