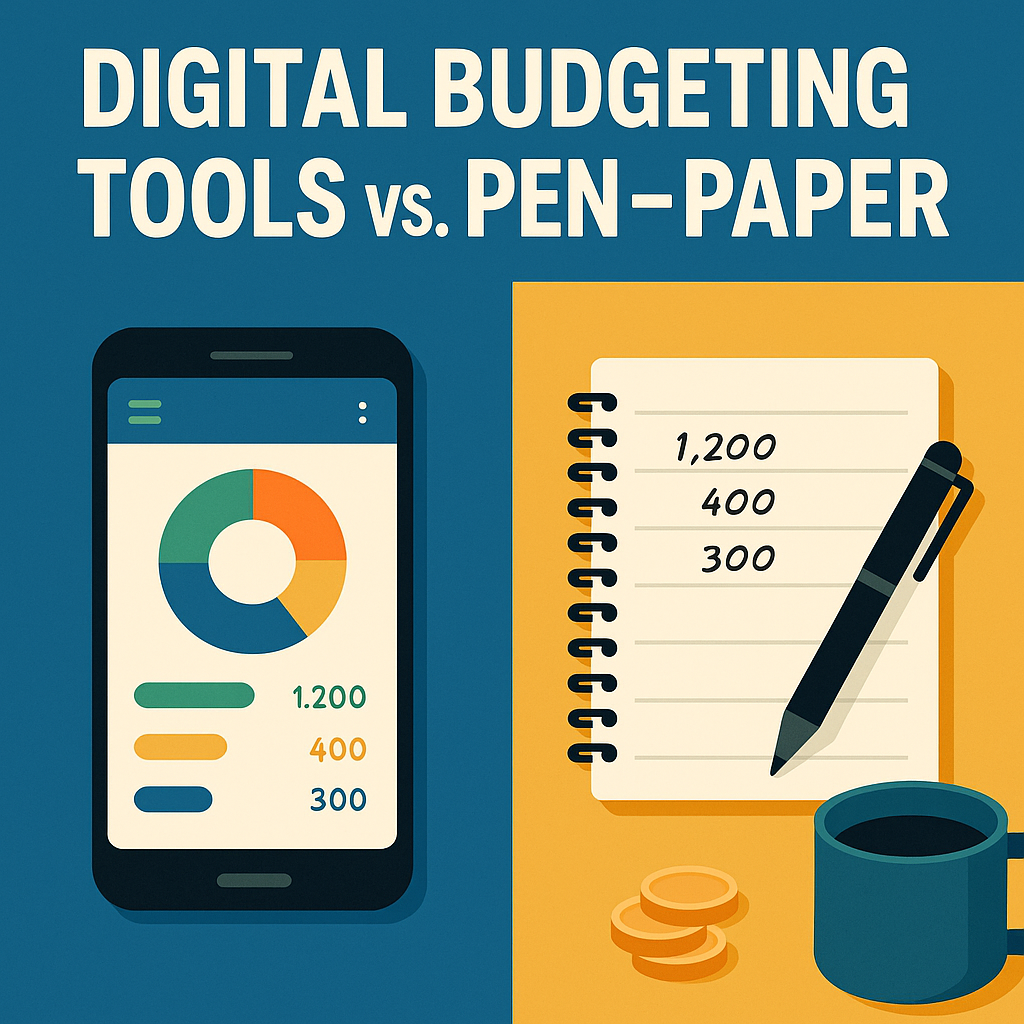

Digital Budgeting Tools vs Pen and Paper: Which Actually Saves You More Money?

Budgeting has been around long before spreadsheets and online calculators existed. Our grandparents managed money with nothing more than notebooks, envelopes, and a bit of math. Today, digital tools — from budget calculators to spreadsheets and expense trackers — promise convenience and precision. But when it comes to actually saving money, do these modern tools beat the old-school pen-and-paper approach?